Imf Sdr Allocation By Country

allocation countryThe SDR is based on a basket of international currencies comprising the US. IMF Members Quotas and Voting Power and IMF Board of Governors Last Updated.

Reserves Sdr Holdings By Country

WHAT IS AN SDR ALLOCATION.

Imf sdr allocation by country. The United States European Union and United Kingdom alone would receive nearly half of the new liquidity. Since SDRs are allocated pro rata in relation to a countrys IMF quota the distribution is heavily skewed towards the bigger and richer countries that arguably have the least need for it. View All Result.

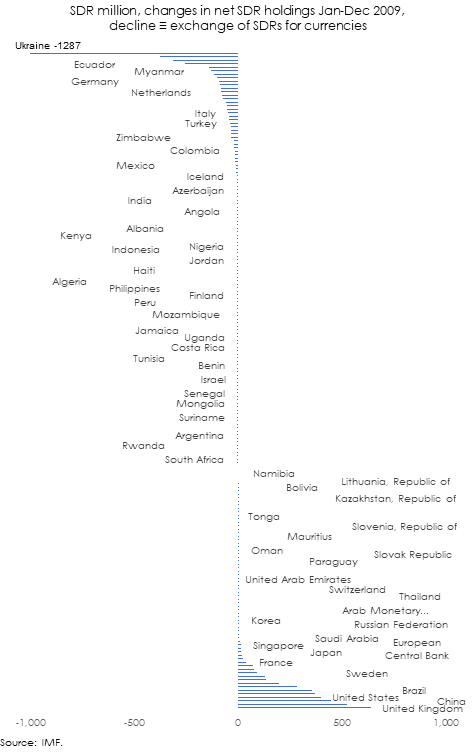

Afghanistan Islamic State of. Special SDR Allocation 2. If a country is running low on currency to pay its foreign obligations say dollars or euros it can exchange its SDRs for the needed currency.

The SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries official reserves. The SDR is not a loan from the IMF but a claim recognized by all IMF member states on each others holdings of reserve currencies. Law limits the size of an SDR allocation that the Treasury Secretary can accept and vote for without pre-approval by Congress.

Antigua and Barbuda 100. Dollar Japanese yen euro pound sterling and Chinese Renminbi. General SDR Allocation 13.

February 11 2021 The Board of Governors the highest decision-making body of the IMF consists of one governor and one alternate governor for each member country. General and Special SDR Allocations in millions of SDRs Member Country. Law limits the size of an SDR allocation that the Treasury Secretary can accept and vote for without pre-approval by Congress.

The IMF does not have any specific limits on SDR allocations but US. Under its Articles of Agreement the IMF may allocate SDRs to member countries who are participants of the SDR Department in proportion to their IMF quotas. The IMF does not have any specific limits on SDR allocations but US.

Which Countries Will Benefit From Increased IMF SDR 12 Feb 2021 Written by Forex DA Posted on February 13 2021 February 13 2021 Less than 0 min read G7 finance ministers are expected to support a new allocation of the International Monetary Funds own currency or Special Drawing Rights SDR on Friday to assist low-income countries. The IMF does not have any specific limits on SDR allocations but US. To most experts the idea seems like a no-brainer but some IMF shareholders have voiced concerns particularly the United States which has a controlling vote in the matter.

The Special Drawing Right SDR is an interest-bearing international reserve asset created by the IMF in 1969 to supplement other reserve assets of member countries. In the late 1960s the IMF was empowered by its shareholders to issue Special Drawing Rights SDRs that the central banks of all IMF members hold in their accounts as reserves. A 2018 IMF Policy Brief states that the SDR allocation increased reserves by about 19 for low-income countries and over 7 for emerging economies excluding China and fuel exporters.

So far SDR 2042 billion equivalent to about US281 billion have been allocated to members including SDR 1826 billion allocated in 2009 in the wake of the global financial crisis. Law limits the size of an SDR allocation that the Treasury Secretary can accept and vote for without pre-approval by Congress. The proposal received strong endorsement from a group of distinguished Latin American political leaders.

The Special Drawing Right SDR is an international reserve asset created by the IMF in 1969 to supplement other reserve assets of member countries. Dollar the euro the Chinese renminbi the Japanese yen and the British pound sterling. Although SDRs remained a small portion of the worlds international reserves Markets reacted favorably to the allocation which formed part of the broader G20 crisis response.

SDRs are limited to governments only and are booked at the IMF. Friday February 12 2021. The value of the SDR is based on a basket of five currenciesthe US.

Many prominent people have advocated that the IMF undertake an SDR allocation to assist countries in dealing with the global financial crisis brought about by the COVID-19 pandemic. A substantial majority of IMF members has expressed support for an SDR allocation at this time including Australia Canada China France Germany Italy and most emerging-market and developing countries.

Back Matter The Future Of The Sdr In Light Of Changes In The International Monetary System

Back Matter The Future Of The Sdr In Light Of Changes In The International Monetary System

Mauritius Mu Imf Account Fund Position Allocations Of Sdrs To Date Economic Indicators

Special Drawing Rights Sdr Insightsias

Special Drawing Rights Sdr Insightsias

4 Special Drawing Rights Imf Financial Operations 2018

4 Special Drawing Rights Imf Financial Operations 2018

Ousmene Mandeng Economics Commentary

Ousmene Mandeng Economics Commentary

Appendix Ii The Sdr The Role Of The Sdr In The International Monetary System

Appendix Ii The Sdr The Role Of The Sdr In The International Monetary System

Evolution Of The Sdr 1974 81 Changes In The Basket Interest Rate And Use Of The Sdr Finance Development September 1982

Evolution Of The Sdr 1974 81 Changes In The Basket Interest Rate And Use Of The Sdr Finance Development September 1982

Crypto Firms Serving Netherlands Must Register With Dutch Central Bank Central Bank Dutch Anti Money Laundering Law

Crypto Firms Serving Netherlands Must Register With Dutch Central Bank Central Bank Dutch Anti Money Laundering Law

Special Drawing Rights Sdr Indiathinkers Brief

Special Drawing Rights Sdr Indiathinkers Brief

Imf Policy Paper The Case For A General Allocation Of Sdrs During The Eleventh Basic Period Report Of The Managing Director To The Board Of Governors And To The Executive Board

Imf Policy Paper The Case For A General Allocation Of Sdrs During The Eleventh Basic Period Report Of The Managing Director To The Board Of Governors And To The Executive Board

Chinese Company The9 Said To Be First Foreign Telegram Ico Investor Investors Ico Securities And Exchange Commission

Chinese Company The9 Said To Be First Foreign Telegram Ico Investor Investors Ico Securities And Exchange Commission

What Does The Current Allocation Of Sdrs Among Member Countries Look Like Quora

What Does The Current Allocation Of Sdrs Among Member Countries Look Like Quora

Explaining Sdrs Special Drawing Rights Drawings Special Japanese Yen

Explaining Sdrs Special Drawing Rights Drawings Special Japanese Yen

Chapter 4 Special Drawing Rights International Monetary Fund Handbook Its Functions Policies And Operations

Chapter 4 Special Drawing Rights International Monetary Fund Handbook Its Functions Policies And Operations

Sdr Allocations By Level Of Development In Millions Of Sdrs Download Scientific Diagram

Sdr Allocations By Level Of Development In Millions Of Sdrs Download Scientific Diagram

Kiribati Ki Imf Account Fund Position Sdr Holdings Of Allocation Economic Indicators

Chapter 12 Two Years Of Experience With Sdrs 1970 71 The International Monetary Fund 1966 1971 The System Under Stress Volume I Narrative

Chapter 12 Two Years Of Experience With Sdrs 1970 71 The International Monetary Fund 1966 1971 The System Under Stress Volume I Narrative

Back Matter International Monetary Fund Annual Report 1996

Back Matter International Monetary Fund Annual Report 1996