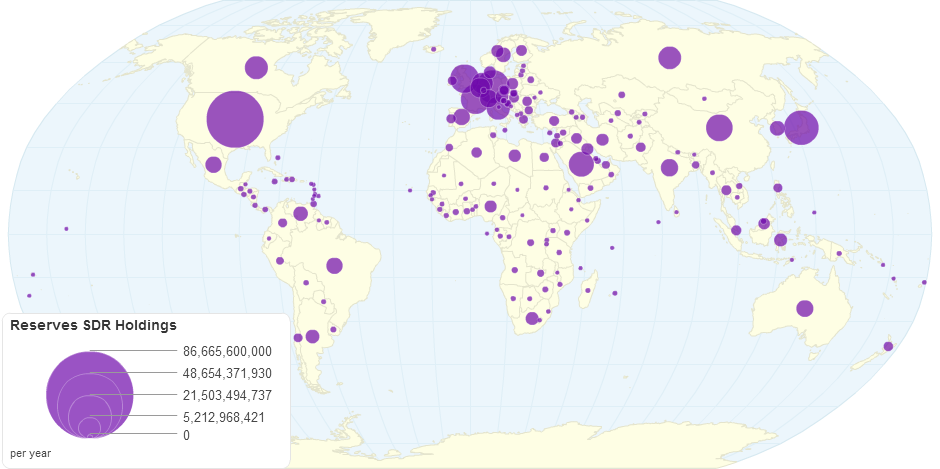

Imf Sdr Allocation By Country

allocation countryThe SDR is based on a basket of international currencies comprising the US. IMF Members Quotas and Voting Power and IMF Board of Governors Last Updated.

Reserves Sdr Holdings By Country

WHAT IS AN SDR ALLOCATION.

Imf sdr allocation by country. The United States European Union and United Kingdom alone would receive nearly half of the new liquidity. Since SDRs are allocated pro rata in relation to a countrys IMF quota the distribution is heavily skewed towards the bigger and richer countries that arguably have the least need for it. View All Result.

Afghanistan Islamic State of. Special SDR Allocation 2. If a country is running low on currency to pay its foreign obligations say dollars or euros it can exchange its SDRs for the needed currency.

The SDR is an international reserve asset created by the IMF in 1969 to supplement its member countries official reserves. The SDR is not a loan from the IMF but a claim recognized by all IMF member states on each others holdings of reserve currencies. Law limits the size of an SDR allocation that the Treasury Secretary can accept and vote for without pre-approval by Congress.

Antigua and Barbuda 100. Dollar Japanese yen euro pound sterling and Chinese Renminbi. General SDR Allocation 13.

February 11 2021 The Board of Governors the highest decision-making body of the IMF consists of one governor and one alternate governor for each member country. General and Special SDR Allocations in millions of SDRs Member Country. Law limits the size of an SDR allocation that the Treasury Secretary can accept and vote for without pre-approval by Congress.

The IMF does not have any specific limits on SDR allocations but US. Under its Articles of Agreement the IMF may allocate SDRs to member countries who are participants of the SDR Department in proportion to their IMF quotas. The IMF does not have any specific limits on SDR allocations but US.

Which Countries Will Benefit From Increased IMF SDR 12 Feb 2021 Written by Forex DA Posted on February 13 2021 February 13 2021 Less than 0 min read G7 finance ministers are expected to support a new allocation of the International Monetary Funds own currency or Special Drawing Rights SDR on Friday to assist low-income countries. The IMF does not have any specific limits on SDR allocations but US. To most experts the idea seems like a no-brainer but some IMF shareholders have voiced concerns particularly the United States which has a controlling vote in the matter.

The Special Drawing Right SDR is an interest-bearing international reserve asset created by the IMF in 1969 to supplement other reserve assets of member countries. In the late 1960s the IMF was empowered by its shareholders to issue Special Drawing Rights SDRs that the central banks of all IMF members hold in their accounts as reserves. A 2018 IMF Policy Brief states that the SDR allocation increased reserves by about 19 for low-income countries and over 7 for emerging economies excluding China and fuel exporters.

So far SDR 2042 billion equivalent to about US281 billion have been allocated to members including SDR 1826 billion allocated in 2009 in the wake of the global financial crisis. Law limits the size of an SDR allocation that the Treasury Secretary can accept and vote for without pre-approval by Congress. The proposal received strong endorsement from a group of distinguished Latin American political leaders.

The Special Drawing Right SDR is an international reserve asset created by the IMF in 1969 to supplement other reserve assets of member countries. Dollar the euro the Chinese renminbi the Japanese yen and the British pound sterling. Although SDRs remained a small portion of the worlds international reserves Markets reacted favorably to the allocation which formed part of the broader G20 crisis response.

SDRs are limited to governments only and are booked at the IMF. Friday February 12 2021. The value of the SDR is based on a basket of five currenciesthe US.

Many prominent people have advocated that the IMF undertake an SDR allocation to assist countries in dealing with the global financial crisis brought about by the COVID-19 pandemic. A substantial majority of IMF members has expressed support for an SDR allocation at this time including Australia Canada China France Germany Italy and most emerging-market and developing countries.